Review of Morgan Housel’s The Psychology of Money

This was a short and enjoyable book, building on stories from a blog of the same name: https://www.collaborativefund.com/blog/the-psychology-of-money/

Whilst it contains nothing ground breaking it does provide some wonderful examples and anecdotes on money, saving and investing.

The book opens explaining that everyones relationship with money is different. Upbringing, where we live, what time we were born, education, cultures, what we read — all shape how to behave with money. This makes understanding money more of a psychological problem rather then a mathematical problem to be solved by spreadsheets.

The book breaks down money into 20 psychological lessons, I’m going to discuss the 7 that resonated the most with me.

1. No One’s Crazy

2. Luck & Risk

3. Never Enough

4. Confounding Compounding

5. Getting Wealth vs Staying wealthy

6. Tails you win

7. Freedom

8. Man in the car Paradox

9. Wealth is what you don’t see

10. Save money

11. Reasonable > Rational

12. Surprise!

13. Room for error

14. You’ll change

15. Nothings free

16. You & me

17. The Seduction of Pessimism

18. When you’ll believe anything

19. All Together Now

20. Confessions

2. Luck & Risk

The involvement of luck and risk in given successes is often overlooked.

Luck

Bill Gates [and Paul Allen] went to one of the the only high schools in the world that had a computer.

Bill Gates is unbelievably smart, hardworking and had the foresight to see how computers would change the world. Yet he had a one in a million chance to have a computer in his school.

Risk

There was a 3rd friend of Bill and Paul’s at school; Kent Evans. Kent was as smart as Bill and they would talk about who would be CEO of their imaginary company. The year before graduation Kent died in a mountaineering accident. Every year there are around 36 mountaineering deaths. One in a million.

with seven billion other people and infinite moving parts. The accidental impact of actions outside of your control can be more consequential than the ones you consciously take.

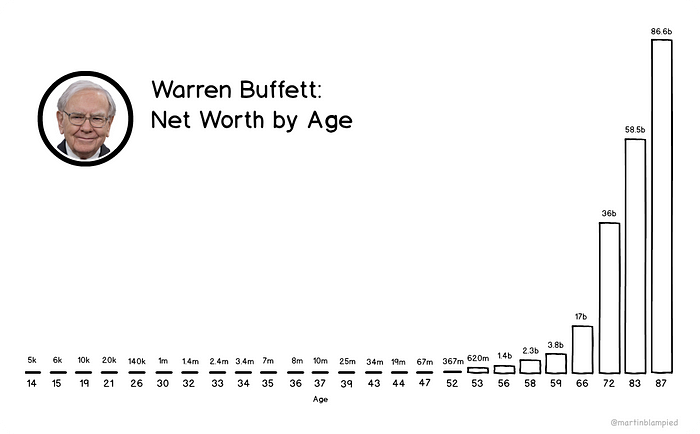

4. Confounding Compounding

Growth is driven by compounding, which always takes time. Warren Buffett has made 99.7% of his money after the age of 52.

Buffet began investing at 10 years old. At 30 he had $1m. Now he has $84.5 billion.

During my 20’s I went travelling and lived abroad for a few years. I didn't really start investing until around 30 years old. Let’s assume at 30 years old I invested $25,000. Also assume I could achieve Buffets insane annual returns of 22% but retired at 60 and withdrew all my investments. My net worth would be $11.9m, 0.01% of Buffets.

To be honest I would be happy with that! I don’t plan to withdraw all investments at 60 and have no regrets waiting till 30’s to start investing or the experiences I had in my 20’s. This is just used to demonstrates the importances of time in the market, NOT timing the market.

6. Tails you win

This chapter summarises the idea, if you make enough bets eventually you will win (assuming you’re not betting everything on it.)

The wonderful anecdote Housel uses is off Disney.

By 1938 he had produced several hundred hours of film. But in business terms, the 83 minutes of Snow White were all that mattered.

He expands this point by saying in investing you only have to be right some of the time:

There are fields where you must be perfect every time. Flying a plane, for example. Then there are fields where you want to be at least pretty good nearly all the time. A restaurant chef, let’s say. Investing, business, and finance are just not like these fields.

If you are right just some of the time, chances are those gains will out perform your loses. It’s not a question of if you are right or wrong, but how much you make when you are right is bigger than how much you lose when you are wrong.

8. Man in the car paradox

This chapter is the stoplight effect + money. The man sitting at the traffic light in the sports car thinks everyone is looking at him and how successful he is. In reality people are looking at the car and thinking how good they would look in it or how much fun it would be to drive.

10. Save money

When most people say they want to be a millionaire, what they might actually mean is “I’d like to spend a million dollars.” And that is literally the opposite of being a millionaire.

The foundation of building wealth is the accumulated leftovers after you spend from what you take in. For most of us increasing income is hard. Clearing bad debt and reducing unnecessary expenditures is much more in out control. Cutting down on buying that coffee wont make you a millionaire but every little helps.

“How do I get rich?” Slowly.

16. You & me

This chapter talks about bubbles and how bubbles form in a way I had never thought about before.

When investors have different goals and time horizons — and they do in every asset class — prices that look ridiculous to one person can make sense to another, because the factors those investors pay attention to are different.

In the dot-com bubble where tech stocks where valued at 1000s revenue, it made no difference to day traders if a stock was $5 or $500 a share, as long as it move in the right direction.

Bubbles form when the momentum of short-term returns attracts enough money that the makeup of investors shifts from mostly long term to mostly short term.

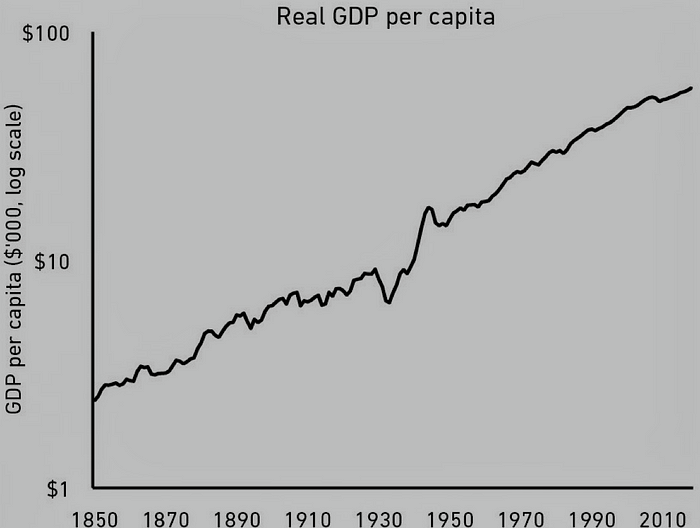

17. The Seduction of Pessimism

Growth is driven by compounding, which always takes time. Destruction is driven by single points of failure, which can happen in seconds, and loss of confidence, which can happen in an instant.

GDP per capital over 170 years. During that time there were 9 major wars, 33 recessions lasting 48 years, 99.9% of all companies went bust, 675,000 Americans died in a single year from flu.

Long term time is our ally, short term time is our enemy. Progress happens too slowly to notice. Set backs happen too quickly to ignore.

News cycles, market speculation, recessions, global pandemics are set backs, often life changing events for people directly involved. Gradual incremental improvements over time very rarely go reported. On 18th April 1930 the BBC announced that there was “No news today”. How times have changed.

What Morgan Housel does with his money

At the end of the book Morgan explains what he does with his money. There is nothing new here. Hold a small emergency fund, save as much of your income as possible to invest in multi asset passive funds such as Vanguard and build multiple sources of income.